Our Industry Reach

We provide best-in-class, full service legal advice to insurtechs, their founders and funders in all aspects and through every stage of their business.

Our clients include many of the world’s most prominent insurance companies, reinsurers, insurance intermediaries, investment banks, sponsors and other financial institutions.

Our market-leading, multidisciplinary team also assists insurance carriers and reinsurers in their digital transformation initiatives, new product offerings and partnerships.

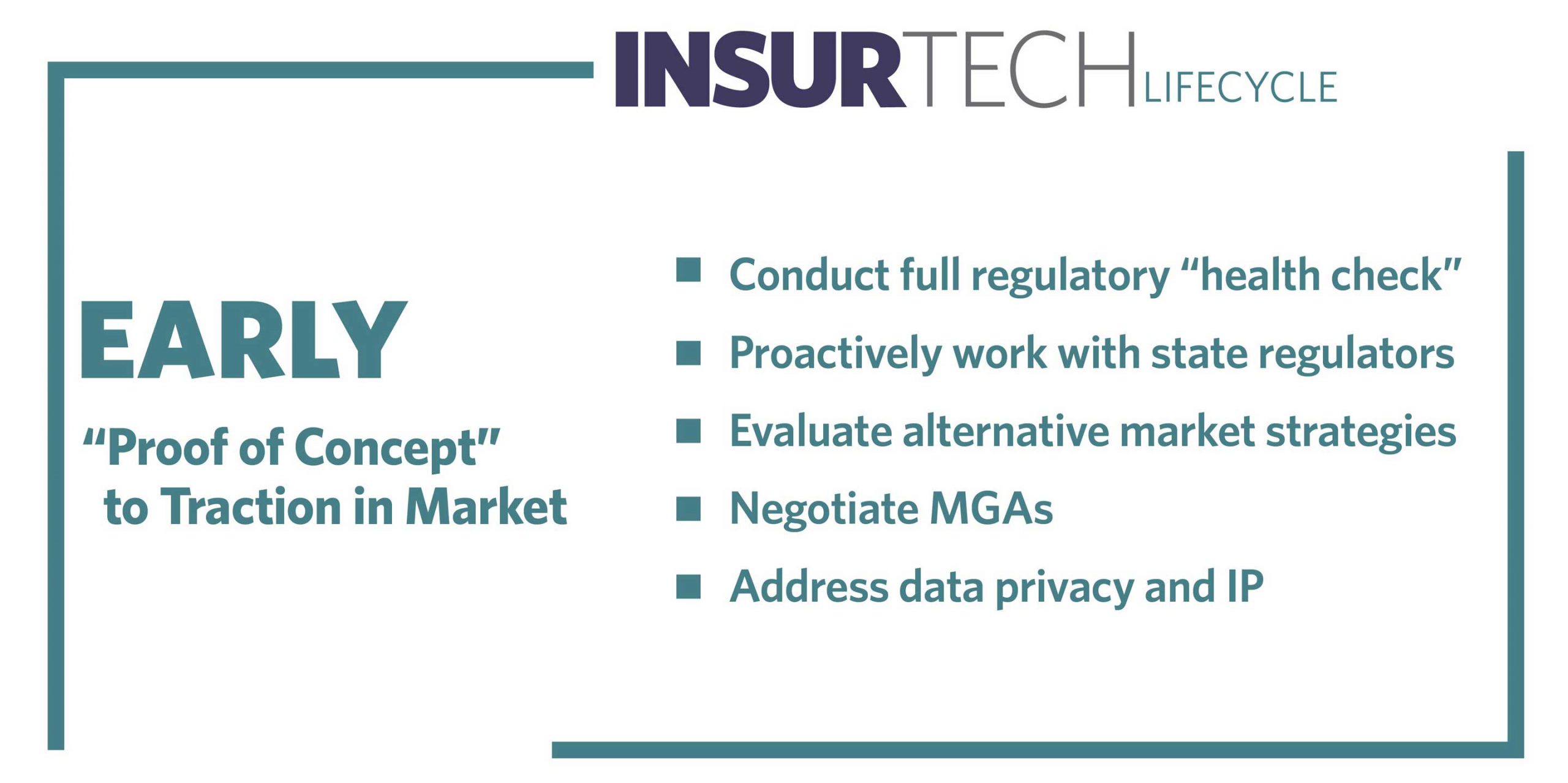

Each insurtech is unique and there is not one route to developing an insurtech business. A fairly typical example of the “insurtech lifecycle” is illustrated below.

Early-Stage

Our deep experience with innovative insurtech entity structures and distribution models makes our team a go-to resource for company founders looking at first getting their insurtech operations off the ground.

We add value by identifying previously unforeseen issues, or suggesting alternative courses of action.

Our insurance regulatory lawyers are known for their extensive capabilities in policy, regulatory intervention, and legislative matters.

Mid-Stage

Clients that have reached mid-stage funding sessions typically look to us to assist in their development of new products and expand into new markets, including through acquisitions.

As a leading insurance M&A law firm, we are working on many insurance intermediary and insurance carrier transactions at any one time.

We also advise on a wide range of captive insurance and alternative risk financing arrangements.

Late-Stage

We have been with insurance industry participants who are now public, or soon will be, every step of the way. We are proud to have advised many insurtechs who are now publicly-traded household names.

As a leader in insurance capital markets, our team has represented many of the industry’s most active issuers and underwriters and has advised on hundreds of insurance securities offerings.

Our understanding of the intersections of regulatory capital, rating agency capital adequacy criteria and capital markets structures distinguishes Willkie as a premier firm for complex insurance financing advice.

Recent representative matters

Insurtech Insurance Advisory and Commercial Work

- Bestow: Representing Bestow, a digital life insurance provider, with respect to all insurance regulatory aspects of its business.

- HDVI: Representing HDVI, a next-generation commercial auto insurance program manager, with respect to all insurance regulatory aspects of its business and its commercial insurance arrangements, including with respect to its program manager platform agreements.

- Ladder: Representing Ladder, a digital life insurance provider, with respect to all insurance regulatory aspects of its business and its commercial insurance arrangements, including with respect to the license expansion of, its carrier, Ladder Life Insurance Company.

- Metromile: Representing Metromile, a digital provider of pay as you go auto insurance, with respect to insurance regulatory compliance, commercial insurance arrangements and strategic growth initiatives.

- Next: Representing Next, an online insurance provider for small businesses, with insurance regulatory and commercial distributions aspects of its business, including with respect to its acquisition to AP Intego, a digital small commercial insurance agency.

- OnStar Insurance/General Motors: Representing OnStar Insurance, the innovative telematics personal auto insurance division of General Motors, with respect to insurance regulatory compliance and strategic growth initiatives.

- Policygenius: Representing Policygenius, a leading online insurance marketplace, with all of its insurance regulatory and commercial matters.

Strategic Insurtech Acquisitions and Investments

- Allstate/Square Trade: Advised Allstate in its acquisition of SquareTrade, a provider of consumer electronics and appliance protection plans, for $1.43 billion.

- Aquiline Capital Partners: Advised Aquiline Capital Partners in the following transactions:

- CodeBlue/MADSKY: Represented Aquiline in the acquisitions and merger of CodeBlue and MADSKY, two industry leaders in the management of interior and exterior damage assessment and repair for insurance property claims.

- Simply Business/Travelers Companies, Inc.: Represented Simply Business and its shareholders (including Aquiline) in the sale of Simply Business, the UK’s biggest business insurance provider, to Travelers Companies, Inc. for approximately $490 million.

- Simply Business: Represented Aquiline in its acquisition of Simply Business.

- Wellington Insurance Group: Represented Aquiline in its majority investment in Wellington Insurance Group, an insurance risk distribution and financial services organization.

- Bestow/Centurion Life Insurance Company: Represented Bestow, a digital life insurance provider, in connection with its acquisition of Centurion Life Insurance Company.

- Compliance Solutions Strategies/AMFINE: Represented CIP Capital portfolio company Compliance Solutions Strategies (CSS), a leading regtech platform serving software clients in the financial services vertical, in its acquisition of AMFINE, a provider of SaaS-based regulatory reporting services to European asset managers, asset servicers and insurers. (2020)

- Homeowners of America/Porch Group: Represented Homeowners of America, a Managing General Agent and insurance carrier hybrid, in its pending acquisition by Porch Group.

- Truist Insurance Holdings/Wellington Risk Holdings: Represented Truist Insurance Holdings in its acquisition of Wellington Risk Holdings, an insurtech that operates as a managing general agent in the admitted residential property markets.

- Truist Insurance Holdings/Constellation Affiliated Partners/RedBird Capital Partners: Represented Truist Insurance Holdings in its acquisition of Constellation Affiliated Partners.